What I didn't realize was how inflated home prices were. A little background info is needed before I start. Dr. Robert Shiller, a professor at Yale and foremost economist when it comes to home prices, wrote a book called Irrational Exuberance in 2000 in which he predicted the tech bubble burst. Then in 2005, he re-released the book with new content that essentially called out the housing bubble burst. He shows in the book through a exhaustive index he created charting home prices that on average, prices rise about .4% a year, when inflation is factored in. From 1940 to 2000, prices rose an average of .7% a year. You get the idea that homes are not great investments from a pure, return-oriented view.

So, how much did homes increase in real value from 1987-1997? None. Actually less than none: -8.46%. The next decade? Home prices increased in real value 82.55% from '88 to their peak in real value in late 2005. Nominal (or not adjusted for inflation) values peaked in 2nd Quarter 2006. Comparing the two decades shows a sharp contrast.

What makes me believe that home prices still have a ways to fall is not simply how inflated prices were, but why they were so inflated. Home prices were so inflated because of increased demand for homes, fueled by a huge increase in credit availability. Basically, when more people can buy homes, demand increases and prices do too. It's not hard to see that right now credit is being restricted and new loans are subject to scrutinization as apposed to securitization. Home prices were a large, juicy bubble, growing ever bigger by lenders, real estate agents and consumers who all believed they could ride the bubble endlessly. They were wrong. All bubbles eventually pop. Whether it be the Stock Market Crash or the tech bubble, when prices are growing only because people expect them to continue to climb, there is a bubble present. Watching home prices tumble and comparing them to technology stocks' plummet in 2000 is easy to do, and probably a reasonable jump to make. While homes have greater intrinsic value than domain names with 25 million in short term debt with no revenue stream did in 2000, they both grew in price because of irrational exuberance, and were brought down by rational investors who figured the bubble out.

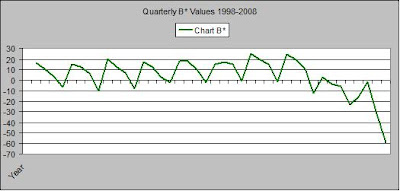

I did some analysis of the data i collected from my paper, updated it, and tried to get an idea of how far prices need to fall in order to be back down to a 'fair' level. What I found shocked me. I'm not going to pretend for a second that I am some sort of math wizzzzard who can predict all markets, but this model did predict prices to fall by a ton, which they have been doing. Basically, I derived a variable, Beta, that is an indicator of how overprices or under priced a asset is. A Beta of 1 means perfectly priced, under 1 ins undervalued and vice versa. Below is the Beta values by quarter over the past decade.

I integrated the curve charting quarterly Beta values and found the displacement from where they should be (equilibrium.) Then I looked at how much they have been displaced so far since the bubble 'burst.' I took A-B=C. C being the amount left to burst. Then I used that number to find out how much prices would fall. The number? 41.209% Shhhhhit.

Do I think home prices will fall 41.209% No. Close to that? Probably not. This number was generated using the assumption of .7% real increase a year being the expected return of a home, and I think that that number is dated. It does show, however, how far prices could fall if long run historical norms are still relevant. I suspect that if prices fall another 20%-25%, buyers will flood the market and prices will begin to return to normal. However, I expect prices to fall at least another 15%-20%, and home prices will probably not return until normal for at least 2 or 3 years.

What does all this mean? It means don't make any investments planning on homes prices rebounding any time soon. Default rates will stay dismal as long as home prices are low, which means more write downs for banks. We're seeing this already, and I think it may continue in a slow and painful way for a while. It doesn't mean I think the stock market will be poor for another 3 years, or even that financial stocks will. But companies that have direct exposure to home prices may be hurting for the short term. Take this with a grain of salt. Do your own research, and let me know what you think. If you would like a more detailed explanation of the model I'm using, or have questions/comments/criticisms, hit me up. (drewo88@hotmail.com)

No comments:

Post a Comment